The Rise in Home Insurance Premiums

Home insurance prices in Florida have been on the rise in recent years, leaving homeowners and prospective buyers wondering about the future of the insurance market in Florida. The state’s unique geographic location, vulnerability to natural disasters, and other contributing factors have made it one of the most expensive places in the United States for home insurance. This article aims to delve into the reasons behind the escalating costs of home insurance in Florida and where the state is headed.

Natural Disasters and Florida’s Geography

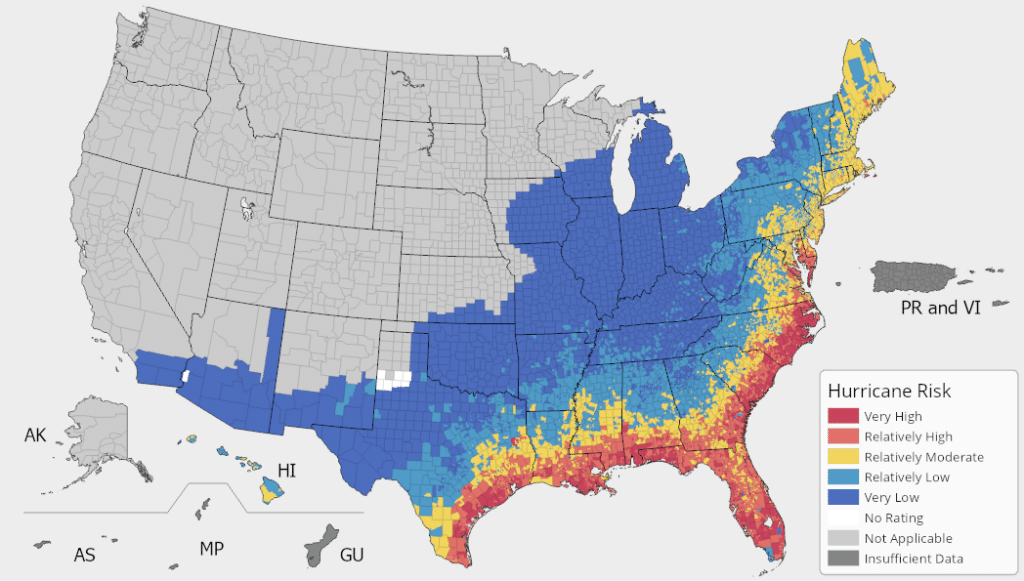

Out of all of the hurricanes to hit The United States 40% of them have hit Florida. This higher chance of being hit by hurricanes has made it so insurance companies no longer find it profitable to stay in Florida. Florida’s geographic location makes it highly susceptible to a variety of natural disasters, including hurricanes, flooding, and sinkholes. The state is situated in the hurricane-prone region of the Atlantic, where powerful storms can cause extensive damage. The frequency and severity of hurricanes in Florida have led insurers to increase premiums to compensate for potential losses. Some insurance providers such as Farmers and AAA have even decided to pull out of the state together.

Insurance Claims History

Florida’s history of catastrophic weather events has resulted in a high volume of insurance claims. This has put pressure on insurers to recoup their losses and maintain profitability. The large number of claims filed in the aftermath of hurricanes and other disasters has led to increased premiums for homeowners across the state. The increase in severe weather events and insurers pulling out of Florida has led Florida home insurance premiums to become one of the highest in the country. Home insurance rates in Florida are expected to jump by about 40% in 2023.

Property Values

Florida has experienced a surge in property values, especially in coastal areas and regions popular among retirees. As property values increase, so does the cost of replacing or repairing homes in the event of damage. Insurance companies consider property values when determining premiums, as higher property values lead to larger potential payouts. Consequently, homeowners in Florida face higher insurance costs due to the appreciation of their property values.

The Rising Cost of Building Materials

The cost of building materials has risen over the past few years making it more costly to repair a home affected by a severe weather event. Materials for new construction have risen by about 15% from October 2021-2022. Asphalt shingles have also increased by about the same amount and lumber has increased by about 6%. This increase in cost has forced insurers to increase premiums to cover the cost of repairing homes.

Increase in Frequency and Severity of Natural Disasters

With temperatures increasing around the globe, the frequency and severity of natural disasters are increasing. With this increase in severity and frequency insurance premiums will also rise to cover the increase in claims. El Niño is also expected to begin this year which will increase temperatures even more than usual. This increase in temperature will make severe weather events more powerful. To learn more about how to be prepared for the 2023 hurricane season check out this blog post.

Conclusion

The rising costs of home insurance in Florida are primarily driven by the state’s vulnerability to natural disasters, particularly hurricanes. The frequency and severity of these events, coupled with high property values and historical claims activity, have led insurers to increase premiums. Homeowners in Florida should be aware of these factors when considering insurance options and take steps to mitigate risks through preventive measures and home improvements.

Prepare your Roof for the 2023 Hurricane Season

Insurers are not letting certain homes renew their policies due to old structures such as an old roof. If you’re looking to prepare for the 2023 hurricane season or renew your policy but are unable to due to an old roof, feel free to use our free instant quote tool to see how much a roof replacement would cost you!